How to Analyze a Residential Real Estate Investment

Investing in residential real estate can be a powerful way to build wealth and achieve financial independence. However, to make smart investment decisions, you need to analyze potential properties carefully. Here’s how I break down the key factors to ensure each investment is a winner, and the common pitfalls to avoid.

1. Net Monthly Cash Flow

Why It Matters: Net monthly cash flow is the lifeblood of any rental property investment. It’s the amount of money left over after collecting rent and paying all the expenses, including mortgage payments, property management fees, maintenance, insurance, and taxes.

How to Calculate:

- Gross Rental Income: Estimate the monthly rent you can charge based on local market rates.

- Operating Expenses: Include costs like property management (typically 8-10% of the rent), maintenance (about 1% of the property value annually), insurance, property taxes, and utilities (if applicable).

- Mortgage Payment: Calculate your monthly principal and interest payment using an online mortgage calculator.

- Cash Flow Formula: Gross Rental Income - Operating Expenses - Mortgage Payment = Net Monthly Cash Flow.

Pitfall #1: Underestimating Expenses. One common mistake is underestimating the operating expenses. Always assume higher than average costs to avoid unpleasant surprises.

I manage my own properties with TurboTenant, but I include 8% Property Management in operating expenses so I pay myself. I mean, what if later on down the road I want to finally outsource that? Well, I already considered the expense!

Be sure to include an allotment for vacancies. Even if you have a clean turnover from one tenant to the next, you might be vacant for two weeks as you clean and prep for the incoming tenant.

Pitfall #2: Caring Too Much about Cash Flow. If you have a high-earning day job and aren't looking to retire early on rental properties, then maybe you don't need to make a lot - or any! - money in monthly cash flow. You'll make it up later - you're playing the long game!

2. Equity Accrual

Why It Matters: Equity accrual is the increase in your property ownership stake as tenants pay down the principal on your mortgage. Over time, this can significantly boost your net worth.

How to Calculate:

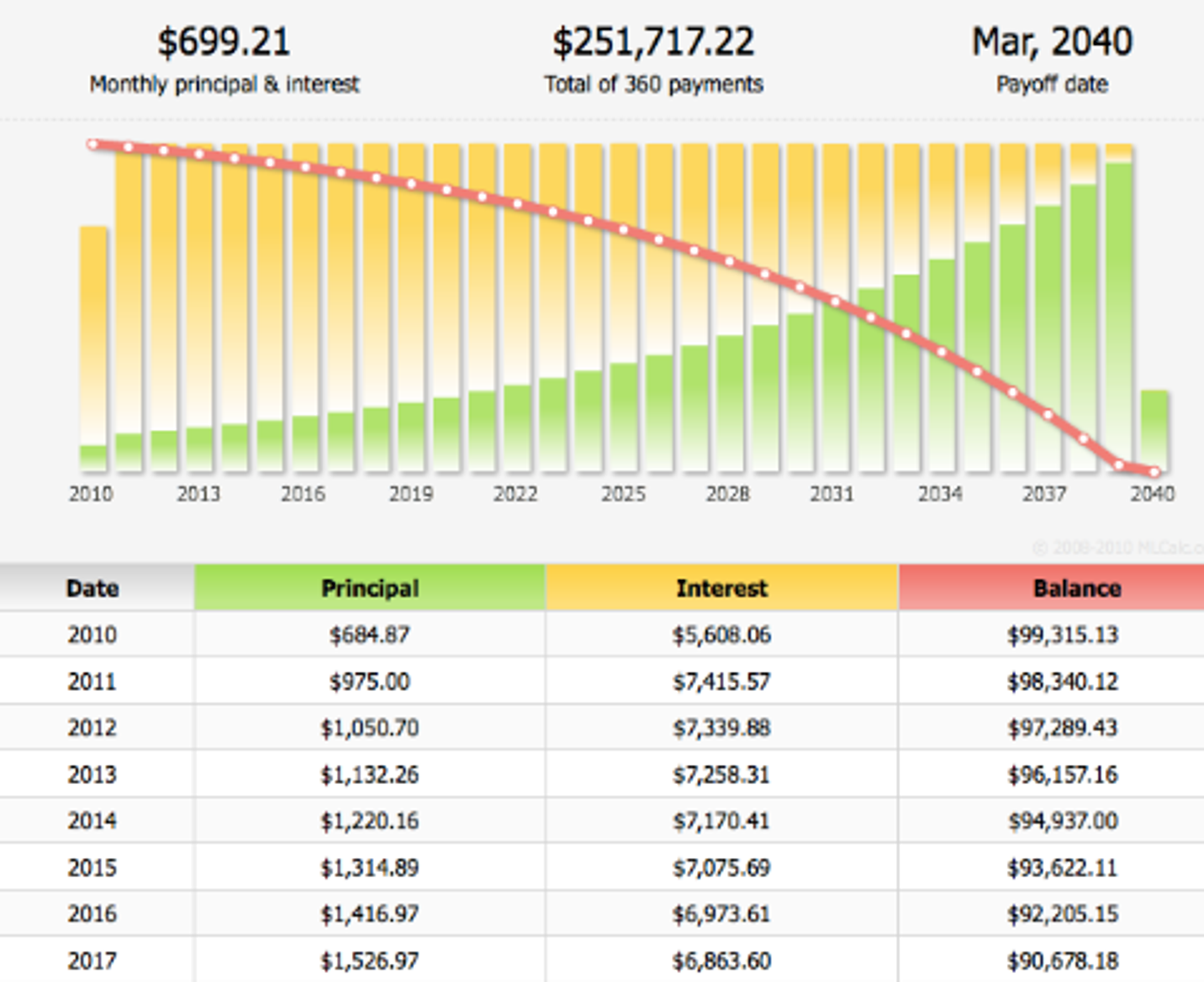

- Amortization Schedule: Use an amortization calculator like this one from Mortgage Capital Partners to determine how much of each mortgage payment goes towards the principal.

- Annual Equity Accrual: Multiply the monthly principal payment by 12 to see how much equity you gain each year. This isn't exact, since the proportion of your monthly payment that goes toward interest gradually rises the farther along the amortization schedule you are.

Tracking your equity accrual helps you understand how much of the property you own outright over time, which can be substantial when accumulated over several years.

Pitfall #3: Ignoring Equity Accrual. Focusing solely on cash flow and ignoring the benefits of equity accrual can lead to undervaluing the investment's long-term potential.

Pitfall #4: Ignoring the Leverage Your Equity Grants you. One of my rental units has over $100K of equity in it. Imagine if I could take out a Home Equity Line of Credit against it and use that money to buy two or three more units!

As you gain wealth, think about how you can make that money work for you.

3. Asset Appreciation

Why It Matters: Real estate tends to appreciate over time, meaning the value of your property increases. This appreciation can be a significant source of long-term wealth.

How to Estimate:

- Historical Trends: Look at historical appreciation rates in your target market.

- Market Conditions: Assess current market conditions and future development plans in the area.

While appreciation rates can vary, understanding the trends can help you project future property values and overall return on investment.

Pitfall #5: Overestimating Appreciation Relying too heavily on future appreciation can be risky. Always base your investment on current cash flow and consider appreciation as a bonus.

4. Tax Benefits

Why It Matters: Real estate investments offer various tax advantages, such as depreciation, which can significantly enhance your overall returns.

Key Benefits:

- Depreciation: You can deduct the cost of the property (excluding land) over 27.5 years for residential properties. This non-cash deduction can offset your rental income by reducing your taxable income.

- Interest Deductions: Mortgage interest is tax-deductible, lowering your overall tax burden.

- Expense Deductions: Expenses like property management fees, repairs, and travel related to managing your property can be deducted.

Consult with a tax professional to maximize your deductions and understand how tax laws apply to your situation.

Standard Rules of Thumb

- The 1% Rule: The monthly rent should be at least 1% of the purchase price. This helps ensure the property will generate enough income to cover expenses. In today's market where interest rates are about 7%, this rule is harder to follow. It was easier when rates were 3%, which is why creative financing (like acquiring a house subject-to the existing loan, which may be at 3%) is so powerful.

My first two units were via conventional financing, which was great when rates were 3% but terrible that I had to put 25% down to acquire them. I acquired subsequent units via creative financing where I could still acquire houses at 4.25% or lower. - 35-45% Rule: Expect that operating expenses (excluding mortgage) will consume 35-45% of your rental income. This conservative estimate helps ensure you don't underestimate costs.

If your rental income is $1,800, then 35% of that is $630 for your operating expenses. If your mortgage is $900, then your net monthly cash flow will be $270. - Cap Rate: Calculate the capitalization rate by dividing the net operating income by the property price. Aim for a cap rate that meets or exceeds the average in your area, typically around 6-8%.

Conclusion

Analyzing a residential real estate investment involves evaluating net monthly cash flow, equity accrual, asset appreciation, and tax benefits while avoiding common pitfalls. By understanding and calculating these factors, and applying standard rules of thumb, you can make informed decisions and build a profitable real estate portfolio.

Ready to analyze your first deal? Use Reico.ai to streamline your property analysis and start your journey towards financial independence today!